Version 1.0

The Smartpay Fuse REST API provides a complete set of tools to integrate with your payment system. It helps you start and manage transactions, and perform key administrative tasks.

This REST API is our main interface for integration, and the primary way to connect with the Smartpay Fuse platform.

You can use the REST API in two main ways:

- On its own to process payments when you collect card details on your site.

- Manage transactions started with other Smartpay Fuse platform tools, such as Secure Acceptance Hosted Checkout and Flex Microform.

Key Steps for Integration

- Review Key Features and Benefits and Integration Feature Comparison to learn more about the REST API and its capabilities. Consider this information before you start your integration. Make sure that a direct REST API integration is the best choice for your system. One of our other integration methods might work just as well, and require less effort to integrate in to your system.

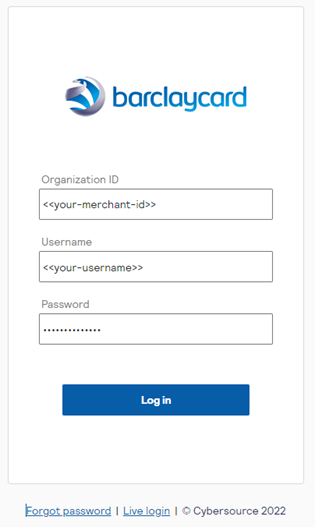

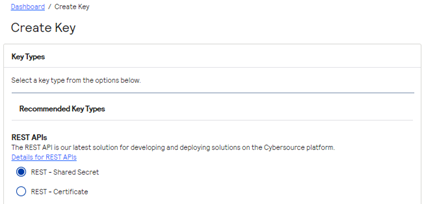

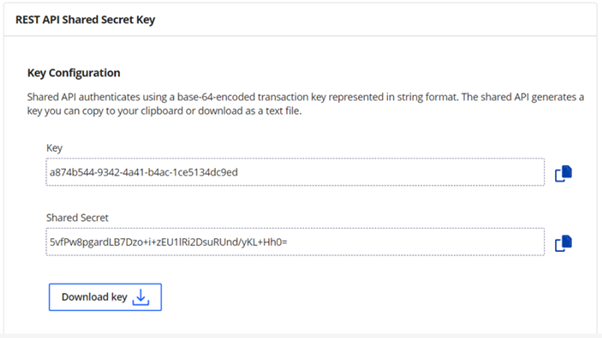

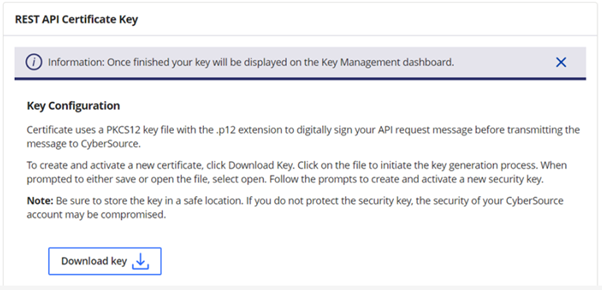

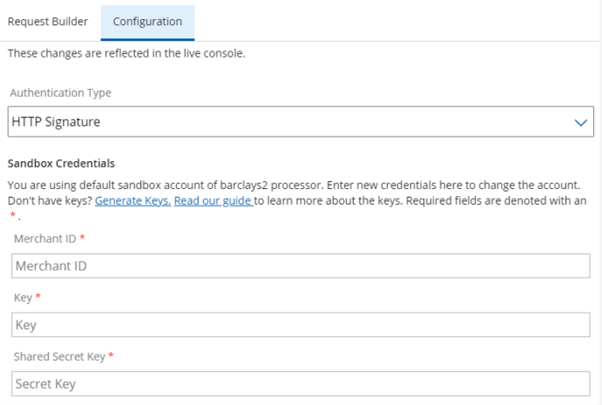

- Choose how to authenticate:

Shared secret

Certificate-based - Create your REST API requests:

Send order and card data using the REST API to start a payment

Add 3-D Secure (Payment Authentication) for e-commerce transactions - Test your integration thoroughly.

- You have full control of the user experience.

- You have full control of the payment process.

- Works for both web and mobile journeys.

- You can access all Smartpay Fuse platform features.

- You can complete transactions started with E-commerce Plugins, Virtual Terminal, Hosted Payment Pages, and Flex Microform integration methods.

The REST API integration is one of several methods to accept payments on your site. Smartpay Fuse offers additional methods that provide different features. Before you start your integration, make sure you choose the right method for your needs. If the capability you need is not supported with the REST API, consider using one of the alternate integration methods.

For more information about these integration options, refer to these quick start guides:

- E-commerce Plugins: provides an easy integration for supported e-commerce platforms.

- Virtual Terminal: no integration is required because servicing agents take payments using our back-office portal, Smartpay Fuse Portal[ebc].

- Hosted Fields: you can capture individual payment card details as PCI-safe fields.

- Hosted Payment Page: requires minimal integration because you initiate the payment page, which handles the entire payment flow.

Contact us if you have questions about the REST API.

This table provides a comparison of the features that are available in the different integration methods.

| Integration Methods | |||||

|---|---|---|---|---|---|

| Features | Virtual Terminal 1 | E-Commerce Plugins | Hosted Payment Page | Direct REST API | Hosted Fields |

| PCI overhead | SAQ C-VT | Mixed2 | SAQ A | SAQ D | SAQ A3 |

| Transaction Types | |||||

Authorization only |

Yes | Yes (all) | Yes | Yes | Yes7 |

Authorization and capture |

Yes | Yes (all) | Yes | Yes | Yes7 |

Tokenise card (COF) |

Yes | Yes | Yes4 | Yes | Yes7 |

CIT (initial/subsequent) |

Yes | Yes | Yes4 | Yes | Yes7 |

MIT (continuous authority) |

No | Some6 | No | Yes | Yes7 |

Refund (standalone) |

Yes8 | Some6 | REST API & Smartpay Fuse Portal1 | Yes | Yes7 |

Refund (existing transaction) |

Yes | Yes (all) | REST API & Smartpay Fuse Portal1 | Yes | Yes7 |

Reversal |

Yes | Yes (all) | REST API & Smartpay Fuse Portal1 | Yes | Yes7 |

Capture of standalone authorization |

No | Yes (all) | REST API & Smartpay Fuse Portal1 | Yes | Yes7 |

| 3-D Secure (v2) | N/A | Yes (all) | Yes | Yes | Yes7 |

| Account validation | N/A | Some6 | Yes | Yes | Yes7 |

| Basic fraud rules5 | Yes | Yes (all) | Yes | Yes | Yes7 |

| Low value exemptions | N/A | No | Yes | Yes | Yes7 |

| AVS/CSC Auto Reversal/Blocking | Yes8 | Yes6, 8 | Yes8 | Yes8 | Yes7, 8 |

| Digital Wallets | |||||

Apple Pay |

N/A | Some6 | No | Yes | No7 |

Google Pay |

N/A | Some6 | No | Yes | No7 |

| Card Types | |||||

Visa |

Yes | Yes | Yes | Yes | Yes |

Mastercard |

Yes | Yes | Yes | Yes | Yes |

American Express |

Yes8 | Yes8 | Yes8 | Yes8 | Yes8 |

| Channels | |||||

E-Commerce |

No | Yes | Yes | Yes | Yes7 |

Moto |

Yes | Some6 | Yes8 | Yes | Yes7 |

Notes:

1: The Smartpay Fuse Portal is our back-office servicing portal.

2: Different plugins use different integration methods. Refer to the applicable quick start guide listed and linked above for details about the PCI implications of those integration methods. Contact support if you have concerns or questions about PCI implications.

3: SAQ A applies when Flex Microforms is used to tokenize from web applications.

4: Secure Acceptance Hosted Checkout creates tokens from initial CIT transactions that can be used for subsequent CIT transactions.

5: Basic velocity rules using Decision Manager are only available for SME clients. Advanced fraud check and TRA are handled on a case-by-case basis.

6: These features are only available on some of our plugins (refer to the individual plugin solution pages for more information).

7: Flex Microform allows card numbers to be safely tokenized in compliance with PC standards. The resulting transient token is used to process or manage the transaction using the direct integration REST API.

8: These features are not enabled out of the box and need further configuration by our support team.

Using the REST API to take payments lets you use all the features of the Smartpay Fuse platform. It gives you full control over how payments are handled and processed. You need to collect the cardholder's details in your front-end applications, and send these details through your back-end system to start the payment process with Smartpay Fuse.

If you decide to collect card details and send them to Smartpay Fuse, those card details go through your own back-end service. This process might require your service to follow a SAQ D-level PCI compliance (see PCI Implications), so consider this integration carefully.

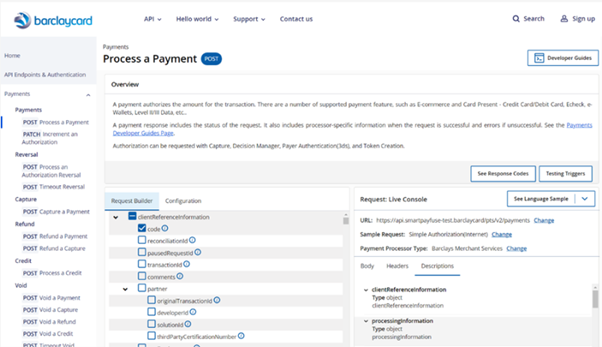

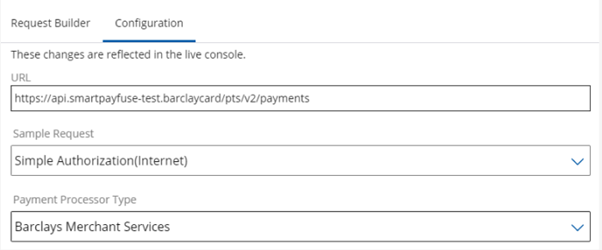

The figure below shows the stages of the payment flow using the REST API:

- The customer processes their order on the merchant website.

- The payment form displays on the merchant website.

- The merchant REST API processes the payment.

- The Smartpay Fuse platform processes the payment.

Please see the Getting Started section below for step by step instructions on how to use the REST API.

The PCI compliance rules to which you need to adhere vary depending how you use the REST API:

- If you capture card details on your website and pass them to the Smartpay Fuse platform using the REST API, the card details pass through your system and network. In this case, you incur the highest PCI level, SAQ D.

- If you tokenize card details using Flex Microform Hosted Fields, cardholder data is already exchanged with Smartpay Fuse, and using the REST API does not require you to pass cardholder data through your service and network. In this case, you incur the lowest PCI level, SAQ A.

If you have any questions or concerns about the PCI implications of using the REST API integration, contact us.