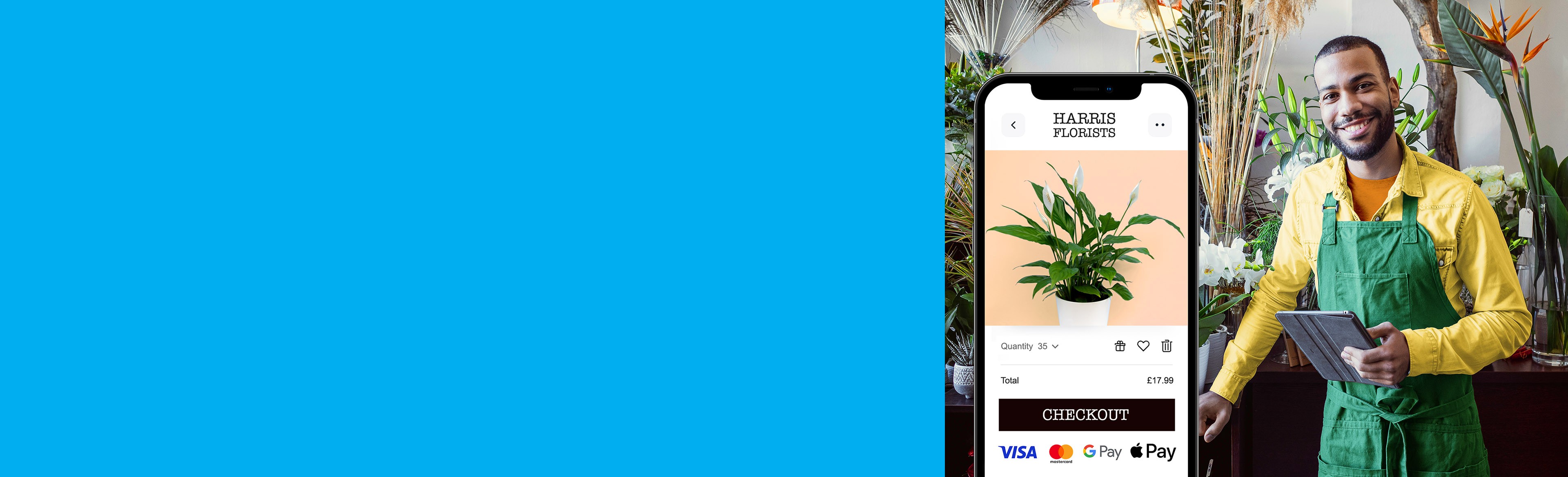

Smartpay Fuse is the online gateway powering payments for small, medium, and mid-sized corporate businesses from Barclaycard Payments, and provides the capabilities and tools to help you take payments online:

- A powerful set of APIs: interfaces to implement a wide range of payment use cases

- Our Enterprise Business Centre (EBC): for administration, maintenance and reporting

- A fully functional sandbox: to try, test and learn

- Sample code, SDK and eCommerce plugins: to illustrate and accelerate your integration, whether web-based or in-app

- Dedicated support: from our Gateway Servicing Team to support your integration

- Multiple payment methods: accept payments from credit and debit cards to digital wallets, such as Apple Pay and Google Pay, as well as other APMs

- Subscription payments: offer recurring payments and subscriptions through an API connection

- Fraud & security: robust fraud protection powered by Decision Manager (additional feature)

- Mail Order Telephone Order (MOTO): Take payments quickly and securely over the phone or even by mail with virtual terminal

- Invoicing: Send your customers a link by email to take them straight to payment with zero integration

- Multicurrency: Accept payments in a range of currencies

See our Quick Start Guides to get going quickly with your chosen integration approach.

If you are not sure about the right integration, keep reading to learn more about Smartpay Fuse and the right approach for your business.

You can speak to a payment’s expert about our other solutions to help you take payments online or face to face, or simply get in touch here.

Smartpay Fuse has been created in partnership with VISA Cybersource. You may notice that some content on this site refers to the Cybersource brand – this is still part of connecting to Barclaycard Payments. Please note that not all features are available by default. Before integrating, please confirm that the features of Smartpay Fuse can meet your needs by getting in touch here.

Smartpay Fuse offers several different ways for you to integrate and to take payments online. These options come with differing integration overheads and levels of functionality. It is important for you to spend a little time selecting the right approach for your needs before jumping in directly to integration.

The following summarizes the key integration options available to you to take payments. If you do not immediately know which option is right for you then keep scrolling to the next section on Choosing the right integration option for your use case.

- eCommerce Plugins: Easy integration to eCommerce platforms with our range of plugins

- Hosted Payment Pages: We host your whole payment page in a styleable solution with low integration and PCI overheads

- Hosted Fields: Card fields are hosted independently, allowing you greater control over styling while retaining reduced PCI overheads

- Direct Integration (REST API): Capture card details on your own website and control payment processing directly with our APIs

If you do not want to create an integration to our service using any of the options above, then it is possible to take Payments using the Virtual Terminal, or send your customers an email with a link using Invoicing via the Enterprise Business centre. Find out more here

Find out more about the "Virtual Terminal" and how to get started here.

When selecting an integration approach, you need to consider a number of factors. We'll consider some of these below and help you choose the right integration option for your particular use case.

eCommerce Plugins

If you are using a third party provided eCommerce platform then you'll most likely want to start by using one of our supported plugins. Opting for this route means you'll get going quickly, with minimal integration effort on your chosen eCommerce platform.

- Install the compatible plugin in your existing ecommerce site

- Configure your plugin credentials so it connects to our gateway

- Start taking payments

Hosted Payment Pages

By far the simplest approach to creating a payment form and presenting that on your website or in a web-view of your application is to use a fully Hosted Payment Page. In this mode of operation, the payment form is served from our servers, so we create the payment form, and you just redirect the customer browser to that form. This keeps all the card details away from your systems, is a simple and quick redirect-based approach and keeps your compliance requirements to a minimum!

See hosted payment page quick start guide

Hosted Fields

If you want to customise the payment form UX beyond the styling capabilities of a Hosted Payment Page, then you may want to consider using "Hosted Fields".

This is very similar to a Hosted Payment Page but rather than us hosting the whole payment form, individual form fields are posted direct from your client-side code to our services, where they are tokenized. This means that card data never passes through your servers, you retain more control over the page UX and can continue the card payment safely with a PCI safe token via our direct APIs.

See hosted fields quick start guide

Direct API Integration

If you want to handle everything yourself, payment forms, card data capture, card data handling then that's all possible by integrating directly to our service from your own back end. Beware though, this mode of operation will incur the highest level of PCI compliance for your back-end !

Smartpay Fuse offers several different options to integrate with the platform, each of which offers a subtly different range of capabilities and control over the payment journey. Before starting integration, it is important to ensure that the option you select provides the right features to meet your business needs.

The table below compares the key features of Smartpay Fuse and how these are supported by the different integration options.

| Features | Virtual Terminal (in EBC *1) | Plugins (eCommerce platforms) | Hosted Payment Page | Direct API Integration (REST API Only) | Hosted Fields (Flex Microform + REST API) |

|---|---|---|---|---|---|

| PCI overhead | SAQ C-VT | Mixed *2 | SAQ A | SAQ D | SAQ A *3 |

| Transaction Types | |||||

|

yes | yes (all plugins) | yes | yes | yes *7 |

|

yes | yes (all plugins) | yes | yes | yes *7 |

|

yes | yes | yes *4 | yes | yes *7 |

CIT (initial/subsequent) |

yes | yes | yes *4 | yes | yes *7 |

MIT (continuous authority) |

no | some *6 | no | yes | yes *7 |

|

yes *8 | some *6 | via REST API & EBC*1 | yes | yes *7 |

|

yes | yes (all plugins) | via REST API & EBC*1 | yes | yes *7 |

|

yes | yes (all plugins) | via REST API & EBC*1 | yes | yes *7 |

|

no | yes (all plugins) | via REST API & EBC*1 | yes | yes *7 |

| 3D Secure Payer Authentication (v2) | n/a | yes (all plugins) | yes | yes | yes *7 |

| Account validation / verification | n/a | some *6 | yes | yes | yes *7 |

| Fraud Tools (Decision Manager)*9 | yes | yes (all plugins) | yes | yes | yes *7 |

| Low value exemption | n/a | no | yes | yes | yes *7 |

| AVS/CSC auto reversal/blocking | yes *8 | yes *6 *8 | yes *8 | yes *8 | yes *7*8 |

| Digital wallets / APMs | |||||

|

n/a | some *6 | no | yes | no *7 |

|

n/a | some *6 | no | yes | no *7 |

| Card types supported | |||||

|

yes | yes | yes | yes | yes |

|

yes | yes | yes | yes | yes |

|

yes *8 | yes *8 | yes *8 | yes *8 | yes *8 |

|

yes | yes | yes | yes | yes |

|

yes | yes | yes | yes | yes |

| Channels | |||||

|

no | yes | yes | yes | yes *7 |

|

yes | some *6 | yes *8 | yes | yes *7 |

| Reporting | no | no | no | yes | no |

| Payout Services | no | no | no | yes | yes |

If you need further guidance on any of these integration options, please don't hesitate to Get in contact with our technical and pre-sales team through the following web-form.

For more information on each of the options please see the following Quick Start Guides:

Notes:

*1 - EBC is our back-office servicing portal; the Enterprise Business Center.

*2 - Different plugins use different integration methods. Please see te Hosted Payment Page, Hosted Fields (Flex Microform) and REST API guides for more details on the PCI implications of those integration approaches. If you are in any doubt about PCI, please get in contact.

*3 - SAQ A when using Flex Microforms to tokenize from web-applications.

*4 - Secure Acceptance Hosted Checkout can create tokenise from initial CIT transactions that can be used for subsequent CIT transactions.

*5 - Basic velocity rules via Decision Manager only available to SME clients; advanced fraud check and TRA on a case by case base.

*6 - Only available on some of our plugins, please see individual plugin solution pages.

*7 - Flex Microform simply allows card numbers to be tokenised in a PCI safe way; using the resulting transient token to process or manage the transaction is done with the direct integration REST API.

*8 - These features are not enabled out of the box and need further configuration by support teams, please contact support

*9 - Decision Manager is an additional product. If you are using a plugin, please check to see if this feature is available.

Each integration option comes with different PCI implications, these are discussed within each of the integration quick-start guides; just select the relevant guide and scroll down to the “PCI implications” section:

To find out more about PCI in general, what it means for you and discover answers to some frequently asked questions, see our PCI guide here.

SmartPay Fuse allows you to take telephone orders via the Virtual Terminal, as well as the ability to send your customers a link via email which takes them directly to a payment page we host on your behalf.

Virtual Terminal can be included in your account by default, providing a simple mechanism for processing customer not present orders within a secure environment.

Invoicing is a powerful transaction processing solution that allows you to process secure ecommerce transactions without the need for integration. Simply send your customer an email directly from your Fuse account, and the customer can click on the link included in that email. In addition, you can add relevant item detail and VAT information, include discounts, schedule reminder emails, and customise the contents of the email your customers receive.