On This Page

Secure Acceptance

Hosted Payments Page Overview

Secure Acceptance

Hosted Payments Page

OverviewBarclays

Hosted Payments Page

is your secure hosted customer checkout

experience. It consists of securely managed payment forms or as a single-page

payment form for capturing payment card data, processing transactions, enabling you

to simplify your Payment Card Industry Data Security Standard (PCI DSS) compliance

and reduce risks associated with handling and/or storing sensitive payment card

information. You, the merchant, out-source capturing and managing sensitive payment

card data to Secure Acceptance

, which is designed to accept card payments.Secure Acceptance

is designed to process transaction requests

directly from the customer browser so that sensitive payment data does not pass

through your servers. Sending

server-side payments using Secure Acceptance

incurs unnecessary overhead and

could result in the suspension of your and subsequent

failure of transactions.To create your customer's experience, take these steps:

- Create and configureSecure Acceptanceprofiles.

- Update the code on your web site to render theHosted Payments Pageand immediately process card transactions. See Scripting Language Samples. Sensitive card data bypasses your network and is accepted bySecure Acceptancedirectly from the customer.Barclaysprocesses the transaction on your behalf by sending an approval request to your payment processor in real time. See Secure Acceptance Hosted Payments Page Transaction Flow.

- Use the response information to display an appropriate transaction response page to the customer. You can view and manage all orders in . See Viewing Transactions in the Smartpay Fuse Portal.

Required Browsers

You must use one of these browsers in order to ensure that the

Secure Acceptance

checkout flow is fast and secure.Internet Explorer is no longer supported.

Desktop browsers:

- Chrome 80, released February 4, 2020 or later

- Edge 109, released January 12, 2023 or later

- Firefox 115, released June 29, 2023 or later

- Opera 106, released December 19, 2023 or later

- Safari 13, released September 20, 2019 or later

Mobile browsers:

- Android Browser 123, released March 12, 2024 or later

- Chrome Mobile 80, released February 4, 2020 or later

- iOS Safari 13, released September 20, 2019 or later

Secure Acceptance Profile

Secure Acceptance

ProfileA

Secure Acceptance

profile consists of settings that you configure to create a

customer checkout experience. You can create and edit multiple profiles, each offering a

custom checkout experience. See Custom Checkout Appearance. For

example, you might need multiple profiles for localized branding of your websites. You can

display a multi-step checkout process or a single page checkout to the customer as

well as configure the appearance and branding, payment options, languages, and customer

notifications. See Checkout Configuration.Secure Acceptance Hosted Payments Page Transaction Flow

Secure Acceptance

Hosted Payments Page

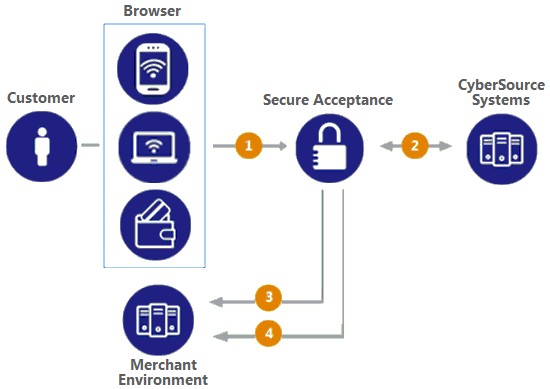

Transaction FlowFigure:

Hosted Payments Page

Transaction Flow

- The customer clicks the button on your website, which triggers an HTTPS POST that directs the customer to the that you configured in . The HTTPS POST includes the signature and signed data fields containing the order information.Hosted Payments Pageworks best with JavaScript and cookies enabled in the customer browser.Your system should sign all request fields with the exception of fields that contain data the customer is entering. To prevent malicious actors from impersonatingBarclays, do not allow unauthorized access to the signing function. See Required Signed Fields.

- Secure Acceptanceverifies the signature to ensure that the order details were not amended or tampered with and displays the . The customer enters and submits payment details their billing and shipping information. The customer confirms the payment, and the transaction is processed.

- Barclaysrecommends that you configure a custom receipt page in so that the signed transaction response is sent back to your merchant server through the browser. See Merchant Notifications. You must validate the response signature to confirm that the response data was not amended or tampered with.Hosted Payments Pagecan also display a standard receipt page to your customer, and you can verify the result of the transaction search in or the standardBarclaysreports.If the response signature in the response field does not match the signature calculated based on the response data, treat the POST as malicious and disregard it.Secure Acceptancesigns every response field. Ignore any response fields in the POST that are not in thesigned_fieldsfield.

- Barclaysrecommends that you implement the merchant POST URL notification as a backup means of determining the transaction result. This method does not rely on your customer's browser. You receive the transaction result even if your customer lost connection after confirming the payment. See Merchant Notifications.If the transaction type if sale, it is immediately submitted for settlement. If the transaction type isauthorization, use theBarclaysSimple Order API to submit a capture request when goods are shipped.

Payment Tokens

Contact

Barclays

Customer Support to

activate your merchant account for the

Token Management Service

(TMS

). You

cannot use payment tokens until your account is activated and you have

enabled payment tokens for Secure Acceptance

. See Creating a Secure Acceptance Profile.Payment tokens are unique identifiers that replace sensitive payment

information and that cannot be mathematically reversed.

Barclays

securely stores all the card information, replacing

it with the payment token. The token is also known as a subscription ID,

which you store on your server.The payment token replaces the card number, and optionally

the associated billing, shipping, and card information. No sensitive card

information is stored on your servers, thereby reducing your PCI DSS

obligations.

Tokens That Represent a Card or Bank Account Only

Instrument identifier tokens

created using the Token

Management Service (TMS) and third-party tokens

represent a payment card number or

bank account number. The same card number or bank account number sent in multiple token

creation calls results in the same payment token being returned. TMS instrument identifier and third-party tokens cannot be

updated. If your merchant account is configured for one of these token types, you

receive an error if you attempt to update a token.

When using

Secure Acceptance

with tokens that represent only the card number or bank account, you must include associated data, such as expiration dates and billing address data, in your transaction request.One-Click Checkout

With

one-click checkout

, customers can buy products with a single click. Secure Acceptance

is integrated to Barclays

, so returning

customers are not required to enter their payment details. Before a customer can use

one-click checkout, they must create a payment token during the first transaction on the

merchant website. See Payment Token Transactions. The payment token

is an identifier for the payment details; therefore, no further purchases require that you

enter any information. When the payment token is included in a payment request, it

retrieves the card, billing, and shipping information related to the original payment

request from the payment repository.To use one-click checkout, you must include the one-click checkout endpoint to process the

transaction. See Endpoints and Transaction Types.

Level II Data

Secure Acceptance

supports Level II data. Level II cards, also known as Type II cards, provide customers with additional information on their payment card statements. Business and corporate cards along with purchase and procurement cards are considered Level II cards.